Disruption in the Automotive and Transportation industry is well under way.

How we get from Point A to Point B is being reinvented due to increasing urbanization.

This is driving the convergence of autonomous, electrification, connectivity and shared transportation systems rapidly.

Auto OEMs and suppliers have to develop and execute new business models to prevent becoming obsolete as these mega trends unfold and technology innovation increases exponentially.

The race is on for Auto OEM’s and suppliers to transform their business and provide multimodal mobility services for the future of mobility.

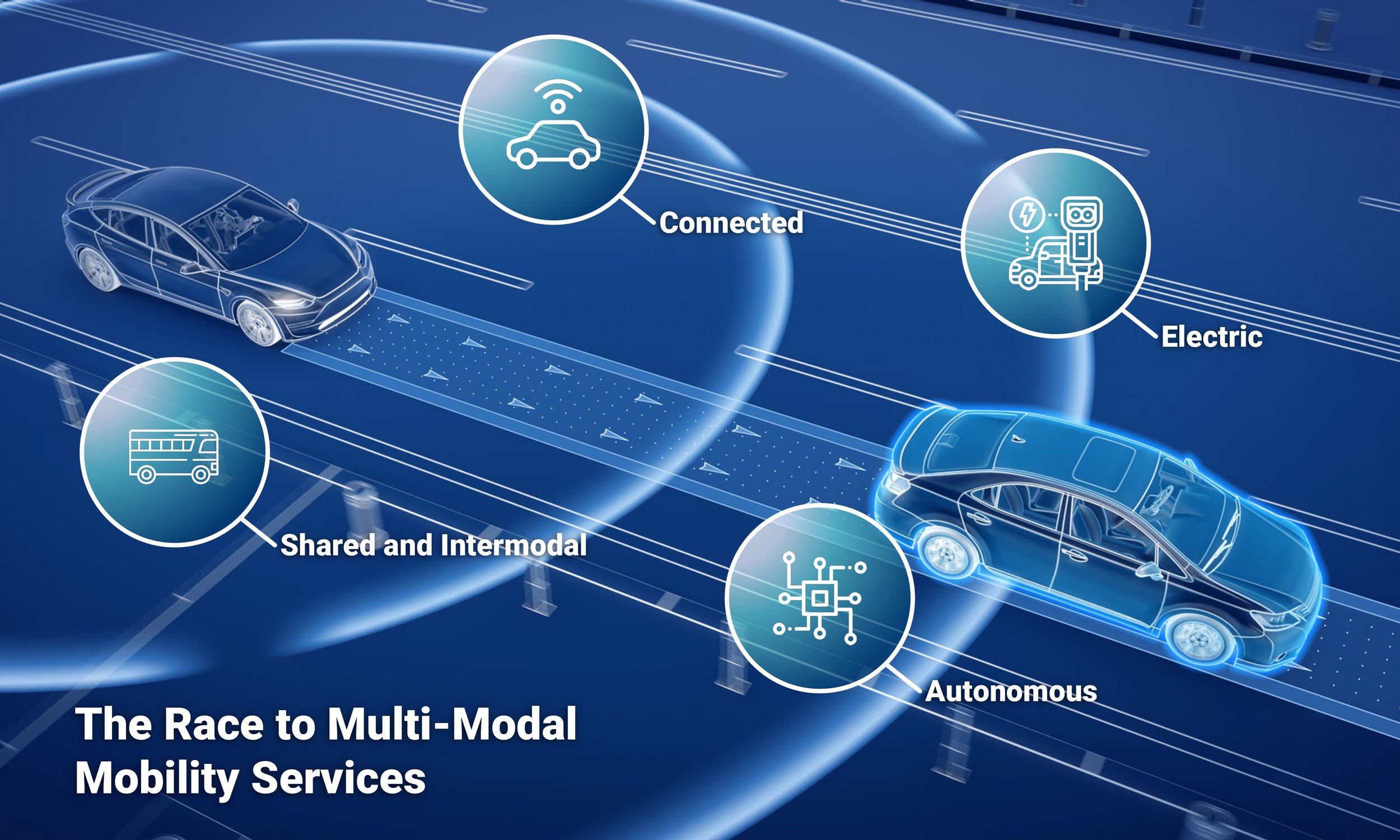

Autonomous Driving.

In 2016, only about 1 % of vehicles sold were equipped with basic partial-autonomous-driving technology. Today, 80 % of the top ten OEMs have announced plans for highly autonomous technology to be ready for the road by 2025.

Shared Mobility.

In major regional and local markets, large shared-mobility providers dominate, with combined market shares of up to 90 %. There is strong growth potential: less than 1 % of passenger miles travelled today are carried out using shared-mobility services, and US customers expect usage of shared mobility to increase by around 80 % once robo-taxis are available.

Connectivity.

Only 12 % of cars today are equipped with embedded connectivity solutions, and monetization is still weak (less than $1.5 billion in revenue). But the importance of cars as part of a connected network for the consumer is growing: the percentage of consumers ready and willing to change car brands for better connectivity has doubled over the past two years. In the premium segment, a majority of OEMs have already installed fully connected infotainment systems in 100 % of their new vehicles. These systems are used to provide a diverse range of in-vehicle services to drivers and diverse data sets to third parties.

In addition of these megatrends, “electrified” – e-mobility – has significant potential to disrupt the market in the short term, due to four powerful forces that are at work today:

Consumer demand shifting in favor of e-mobility

Faster-than-anticipated improvements in key technologies

Increased urbanization across the globe, creating more pull for green mobility solutions

Accelerating regulatory forces at national, regional, and city levels.

A fact is certain: electrification is here to stay.

There are multiple estimates in the market and forecasts of the percentage or penetration of EV as part of the overall Automotive market.

In this survey from Boston Consulting group – the ESTIMATED EV MARKET SHARE IN 2030 is 48%.

This includes Hybrid electric vehicles HEV as well as Battery Electric Vehicles BEV. Assuming an annual market of 100 million units this represents a significant number.

Currently EV penetration is around 6% with rest being made up by ICE (both Gasoline and Diesel).

E-powertrain accounts for over 50% of the EV and decreasing battery cost is crucial to the success of EV industry.

This chart shows that for an ICE vehicle the powertrain accounts for 16% of the cost.

So a key to reducing the cost of EV is to reduce the cost of the battery Pack – analysts predict that it needs to come down to around $150/kwhr to be competitive with the conventional gasoline vehicle. Significant strides have been made in this area over the last decade.

Key Enablers are accelerating EV and Hybrid growth

A number of enablers are accelerating the growth of EV and Hybrid production. These include advancements and Batter Technology, the influx of investments creating new Startups and new Business Models, in some countries Government Regulations or mandates are the main driver and finally changes in Infrastructures to support electrification.

Beyond the obvious changes required to design an electric vehicle, manufactures are trying to anticipate what will be the required changes to manufacturing in order to support efficient and cost effective production of these vehicles.

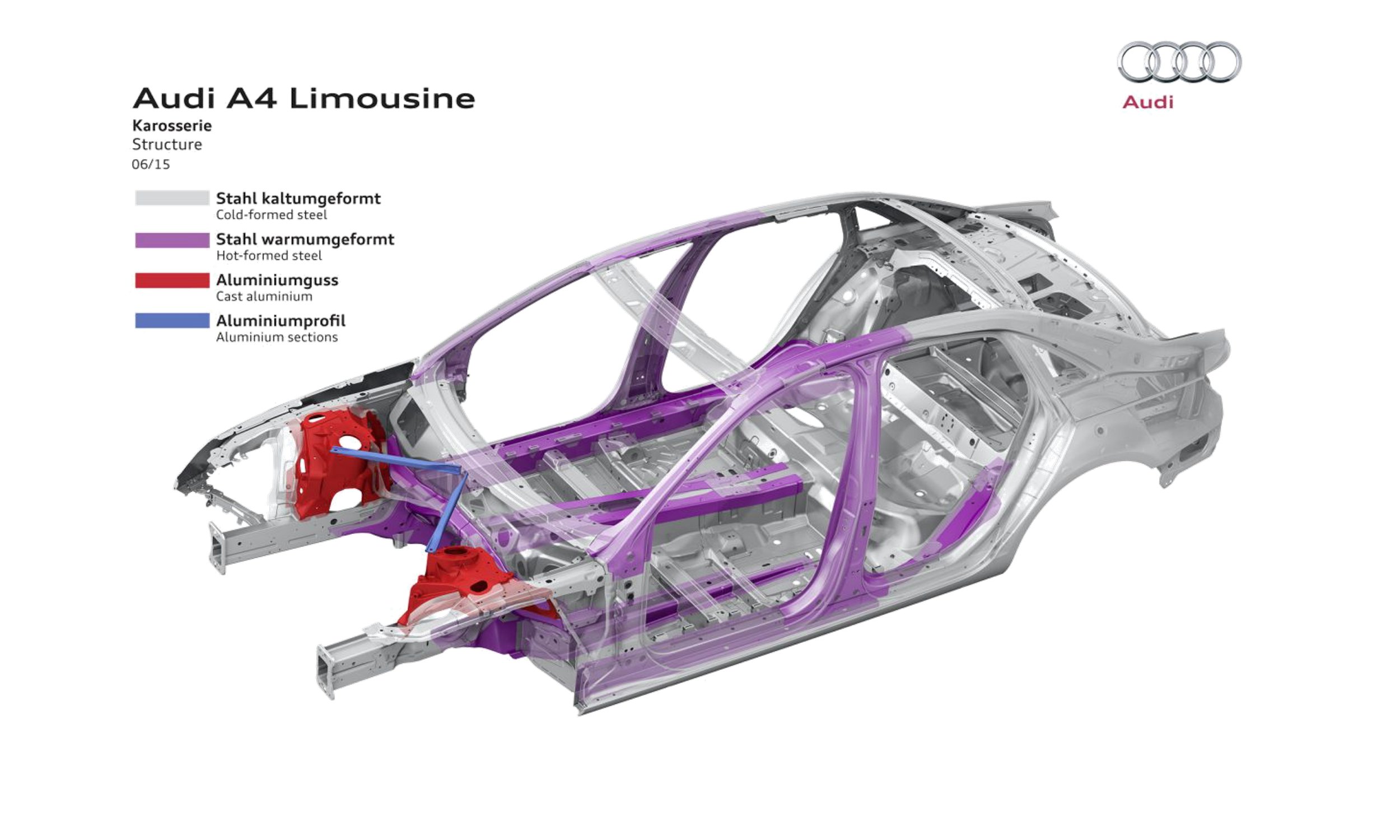

Weight reduction is an important design driver for range

Advanced materials are essential for boosting the fuel economy or range (EV’s) of modern automobiles while maintaining safety and performance. Because it takes less energy to accelerate a lighter object than a heavier one, lightweight materials offer great potential for increasing vehicle efficiency. A 10% reduction in vehicle weight can result in a 6%-8% fuel economy improvement.

Replacing cast iron and traditional steel components with lightweight materials such as high-strength steel, magnesium (Mg) alloys, aluminium (Al) alloys, carbon fiber, and polymer composites can directly reduce the weight of a vehicle's body and chassis by up to 50 % and therefore reduce a vehicle's fuel consumption.

Yet cost of weight reduction plays important role – Design-to-cost efforts has already made its way into EVs

Source: Published VW documents

Additive Manufacturing will be one of the key enablers to realize light weighting targets and will be an integral part of the Body Shop going forward. AM will allow the introduction of new materials that provide superior part performance characteristics, allow for designers to rethink design without constraints that traditional manufacturing techniques imposed as well as simplifying assemblies by consolidating parts.

How will assembly processes be effected by the introduction of these new components?

Key Points:

Assembling complex geometries requires precise programming and orchestration:

Welding seam definition based on the product geometry

Tool orientation with regards to collision constraints and robot configuration

Robotic Off-line Programming

e-Mobility (Electric drive, connectivity, autonomous) are driving new vehicle architectures

Native EV platforms have proven advantageous over non-native models in multiple ways. Batteries of native electric vehicles require less compromise and allow greater flexibility.

As native EVs have to compromise less, particularly in their architecture and body in white, they can accommodate a bigger battery pack, which in turn correlates with higher range. This is evidenced by the fact that native EVs have on average a 25% larger battery pack volume (relative to body in white volume) compared to non-native EVs. One reason is that the body structure can be fit around the battery pack and does not have to be integrated in an existing architecture. This additional freedom in design typically resulting in larger batteries also leads to other potential advantages such as higher ranges, more power or faster charging.

Powertrain Options: inherent flexibility of native EVs plays an important role in this as well. For example, battery packs can house a varying number of active cells while keeping the same outer shape, and variable drivetrain technologies can allow to produce rear-wheel, front-wheel, and all-wheel drive on a single platform.

Source: A2Mac1; McKinsey Center For Future Mobility

Is it possible to validate planned processes prior to implementation on the production floor?

New assembly processes need to be evaluated to confirm feasibility and ensure productivity:

Validate manufacturability of parts and assemblies

Reduce costly late changes to tooling

Ensure operator health and safety to reduce injury

Can we avoid dedicated product lines with hard tooling and conveyance?

The design of a modern material delivery system requires comprehensive logistics planning and simulation:

Consider production rate

Identify delivery locations

Review aisles and routes for delivery

Is it possible to avoid delays at start of production?

To avoid lengthy ramp-ups, control software should be validated and optimized prior to launch:

De-bug controls logic

Test safety interlocks

Validate HMI and diagnostics messaging

Train production personnel

Battery Production - Design for Manufacturing, Production Capacity

Even though global demand for EV batteries is expected to rise significantly, it will not catch up to the planned production capacity in the near term and forecasts (BCG) state that by 2021 we could hit an overcapacity.

Battery producers will counteract the lower prices that result from overcapacity and help the entire mobility industry realize the potential of EVs. Producers cannot count on superior cell chemistry to save their economics. To achieve profitability, they need to reduce manufacturing costs.

Because cells represent about 70% of total battery pack costs, cell production is the most important step of battery production to target in order to reduce the price of battery packs. Production-related costs (excluding materials) represent 30% to 40% of cell costs.

There are two main ways to reduce cell production costs: using advances in production accuracy and cell chemistry to increase energy content at the same volume and weight (that is, energy density) and applying factory-of-the-future concepts (which improve plant structure and processes and digitize the plant) to reduce manufacturing costs. These approaches can similarly be applied to module and pack assembly, enabling cost reductions at the overall battery level.

The application of next-generation digital technologies enables battery factories to transition from the earliest stage of Industry 4.0 maturity (transparency in operational performance) to the most advanced factory-of-the-future design (fully automated factories). Total battery cell costs per kWh of capacity can be reduced by up to 20%, above and beyond savings that result from improvements to production accuracy and chemistry.

Siemens Comprehensive Solution for Battery Cell Production

Benefits of the Digital Twin of Battery Cell Production

A Complete Model

Supports Decisions

Addresses Complexity

Quick and Efficient

Supports Detailed 3D

Virtually Commission

Should everything in the plant be fully automated in order to increase volume?

Manufacturers must:

Balance level of automation and manual processes

Validate processes and cycle time

Minimize lost worker days

How can robotics be utilized to support flexible processes?

Designing flexible workcells

Ensure equipment function and placement

Reduce programming time

Verify robotic interlocks with automation control

Commission workcell prior to physical launch

The introduction of robotic workcells is one way to support complex processes that are not suitable or safe for manual execution. Robots can be utilized to support flexible processes in a very repeatable fashion. However, programming needs to be orchestrated in such a way to properly interface with other aspects of workcell control such as synchronization and safety. Process Simulate is one of the leading tools for digitally engineering and validating robotic applications.

Process Simulate can enable engineers to select and place robots properly in a workcell so that they may fulfill all of the required tasks. Potential interference conditions and or safety concerns can be validated and solved prior to physical installation.

Programming and interlocks with other automation can be fully programmed and validated prior to launch.

Can the Digital Twin of Production be utilized to optimize a system after the start of production?

Multiple aspects can be monitored and utilized to optimize a production system

Evaluate and optimize overall system performance

Material flow and logistics

Product mix

Energy Consumption

Improving Efficiency

Verify Throughput

Evaluate Capacity and Equipment Utilization

Optimize Energy Consumption

Reducing Inventory

WIP Inventory / Turns

It is not enough to just consider individual production workcells. In order to fully understand and optimize production we must consider the entire system behavior from many different points of view. By leveraging Plant Simulation engineers can perform multiple simulations experiments in a very short period of time so that they may have the confidence that their plan and design will meeting production requirements. Models are often developed with varying degrees of detail in order to answer critical questions at any phase of the engineering life cycle.

These models are often utilized to evaluate and fine tune system architecture (buffer locations, decoupling), material flow and logistics and even scenarios to optimize energy or power consumption.

Models are often parametrized with statistical inputs so that system process robustness can be evaluated. Analysis often includes bottleneck analysis, shift planning and other “what if” type scenarios.

Some customers are even using the models after Start of Production (SOP). By feeding data collected directly from their shop floor they are able to determine the root cause of a particular production deficiency and then implement changes to prevent future failures.

Supplier Evolution

Supplier content has increased steadily in the last three decades; old concept of captive suppliers (those owned by and solely serving a particular carmaker) such as Delphi or Visteon no longer applies. Average supplier content in a new automobile at about 65% LG Chem and LG Electronics supplied 87 % of the Chevy Bolt’s powertrain, batteries and infotainment system.

Disruptive Suppliers

As EVs and plug-in hybrids attain mass-market status, automakers will tap the consumer electronics industry for cutting-edge technology, rather than waiting for traditional parts makers to catch up. Consumer electronics purveyors such as LG Electronics, Toshiba, Bosch and Panasonic will exploit their economies of scale to reduce the cost of EV electronics.

Likewise, automakers will turn to battery makers such as LG Chem, Panasonic, Samsung, Toshiba and Hitachi to secure a stable supply of batteries. That trend has begun. Honda Motor Co. announced a joint venture with a Hitachi subsidiary to produce EV motors. And General Motors is working closely with LG Electronics and LG Chem, which produce key components for the Chevrolet Bolt.

Finally, automotive OEM and supplier relationships will become more important and more complex. For automotive OEMs, this transition will present new challenges in managing their supply chains including lead-time, quality assurance and traceability of the product lifecycle across organizations. Suppliers will see a great opportunity for growth and evolution into providers of more complete vehicle sub-systems. With growth, however, comes additional risk. OEMs will set aggressive time-to-market goals for increasingly complex systems. In addition, suppliers will need to ensure robust collaboration and traceability procedures are in place as they work with OEMs and other suppliers.

What are the most relevant standards for electric vehicle testing?

From a testing and certification perspective, electric vehicles bring together two previously separate worlds: the automotive industry (ISO standards) and the electrical industry (IEC standards). Furthermore, electric vehicle testing covers a very broad spectrum of technology and equipment, ranging from EV charging systems to battery packs and cells. As a result, a wide variety of standards could be relevant, depending on which specific aspect you are involved in, and where your sales markets are (e.g. Europe, USA, Asia, worldwide).

Tesla is a fully electric Vehicle Automaker Head Quartered in Northern CA

Tesla has paved the way for EV market and has sparked other start up companies to follow in its footsteps.

Uniti Sweden is developing an electric car that offers drivers the same seamless digital experience they enjoy with their smartphones. Says CEO Lewis Horne, “We don’t focus so much on your vehicle identification number as your digital identity.” The company used Siemens engineering, manufacturing and production software to take their vehicle from concept to reality in four months.

Siemens solutions help a startup transform into a pioneer in digitalized design, development and manufacturing

How can we help you?

Interested in our engineering and consultancy services? Send us your inquiry via the Engineering and Consultancy Services Form and we will be pleased to help you.